Get funds fast.

Apply in minutes,

get approved in hours.

Loans that fit you.

Business loans and credit

lines up to $1 million.

Real people, smart matches.

We pair your business

with the right lender —

not just the first one.

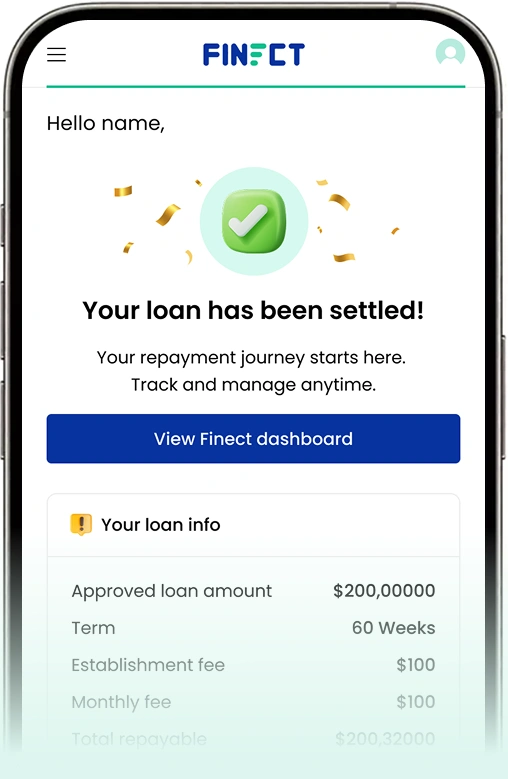

Your finance hub.

Track, refinance, and

manage everything inside

your Finect Dashboard.

Finance that works as hard as you do

Unsecured business loans

Access from $5,000 to $500,000, based on your monthly turnover.

No property needed — just your business performance.

Fast approvals, funds in 1–2 business days.

Secured business loans

Access from $10,000 up to $1M+ using property as security.

Perfect for business expansion, refinancing, or major purchases.

Simple documentation and funding possible within 2 business days.

Line of credit

A cashflow boost on demand, with access up to $500,000. Draw

what you need, when you need it —only pay interest on what you use.

Invoice & Trade Finance

Turn unpaid invoices or overseas orders into instant working

capital. Free up cash tied in invoices or stock purchases.

Keep cash flowing without the wait.

Asset & Equipment Finance

Construction & Development Finance

Looksmart Alterations

Savvy Loans Partner Team

Jacob Borg, ARC Lending Network

Why business owners choose Finect

Fast turnarounds

No hidden fees

We work with you

we’ll find a way forward

Real people, real results

who understand business.

Trusted lender network

Who we help

including start-ups ready to take the next step.

We can help if you have ATO debt but need to keep cashflow steady

You have bad credit but a strong business story

If you have limited financials but proven trading activity

You have been declined elsewhere and need a fresh solution

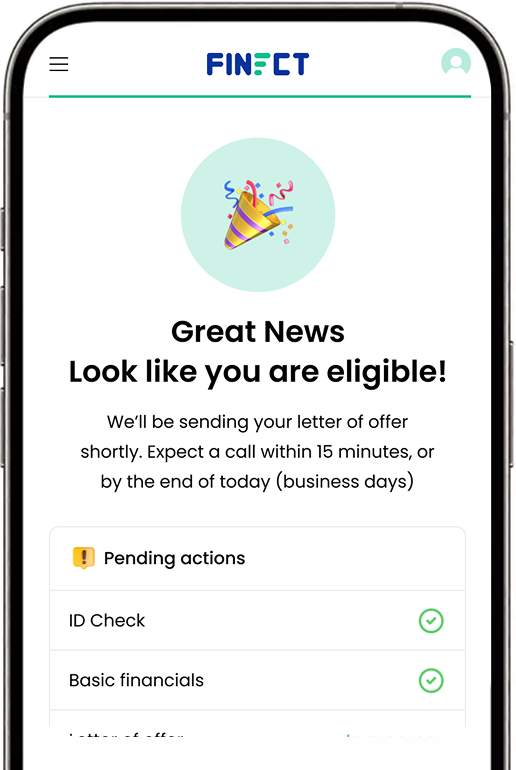

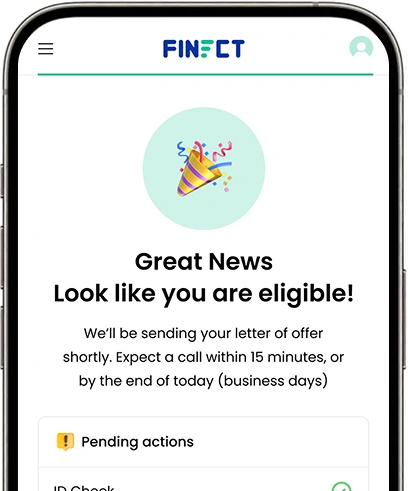

Simple, transparent, fast

Apply in minutes, assessed in 24 hours

No long paperwork or upfront commitments.

Review tailored offers in your dashboard

We match you with the right product and lender.

Receive your funds fast

Access up to $1 million, with funding possible in as little as 1–2 business days.

You focus on the business.

We’ll handle the finance.

Whether it’s cashflow, growth, or getting through a tough patch — Finect connects you with finance solutions that work.

Let’s get

your business

moving

Common questions answered

How quickly can I get funded?

How much can I borrow?

We can help secure funding from $5,000 up to over $1 million, depending on your business needs, structure, and turnover. Whether you’re after a short-term cashflow boost or large-scale expansion finance, we’ll match you with the right lender and product to suit your goals.

Do I need property to apply?

Not necessarily. Finect offers both secured and unsecured finance options. Many of our clients access funding purely based on their trading performance, while others choose to use property or assets to unlock higher limits and sharper rates. Our team will guide you on the best option for your situation.

Can you help if I have bad credit or ATO debt?

Yes. We take a common-sense approach to lending and understand that credit scores don’t tell the full story. Whether you’ve got an ATO debt, missed payments, or past defaults, we’ll look at your business performance today and find a solution that fits. If the business makes sense, we’ll make it happen.

What industries do you work with?

We work with businesses across all industries — from trades, transport, and construction to hospitality, retail, e-commerce, and professional services. Our network of lenders covers a wide range of business types and cashflow cycles, so we can tailor finance to how your business operates.

How long does the process take from start to finish?

The online application takes just a few minutes to complete. Once submitted, you’ll usually receive your first offer within 24 hours. Depending on the facility type, funding can occur in as little as 1–2 business days. For larger secured loans, settlement typically occurs within 3–5 business days after approval.

Will applying affect my credit score?

No — not at the start. Your initial application through Finect involves a soft check, which doesn’t impact your credit score. A formal credit check only occurs if you choose to proceed with a lender and give consent, ensuring you can explore options risk-free.

Are there any upfront or hidden fees?

No hidden fees. We believe in transparent, upfront pricing — you’ll always know what you’re paying before you commit. Fees and costs (if any) are clearly outlined in your offer so there are no surprises down the track.

Can I apply if I’m a start-up?

Yes, we regularly help new and early-stage businesses access funding. While newer businesses may need to show basic trading history or projected cashflow, our team specialises in low-doc and alternative finance options designed for start-ups ready to grow.

Why should I apply through Finect instead of directly with a lender?

Applying directly with a lender often triggers a hard credit check, which can impact your credit score — even if you’re just exploring your options.

When you apply through Finect, we compare multiple lenders and products on your behalf using soft checks only, so your credit file stays unaffected until you decide to proceed.

We also know which lenders move fast, who handles specific industries best, and what documentation they’ll need — saving you time, stress, and unnecessary credit inquiries.